Calculate depreciation of laptop

Calculate his annual depreciation expense for the year ended 2019. Use the modified accelerated cost recovery.

Achive Your Goals To Become An Expart On Machine Learning Machine Learning Data Science Science Method

Because your laptop was two years old it has cost 40 of its value here before being destroyed by the fire.

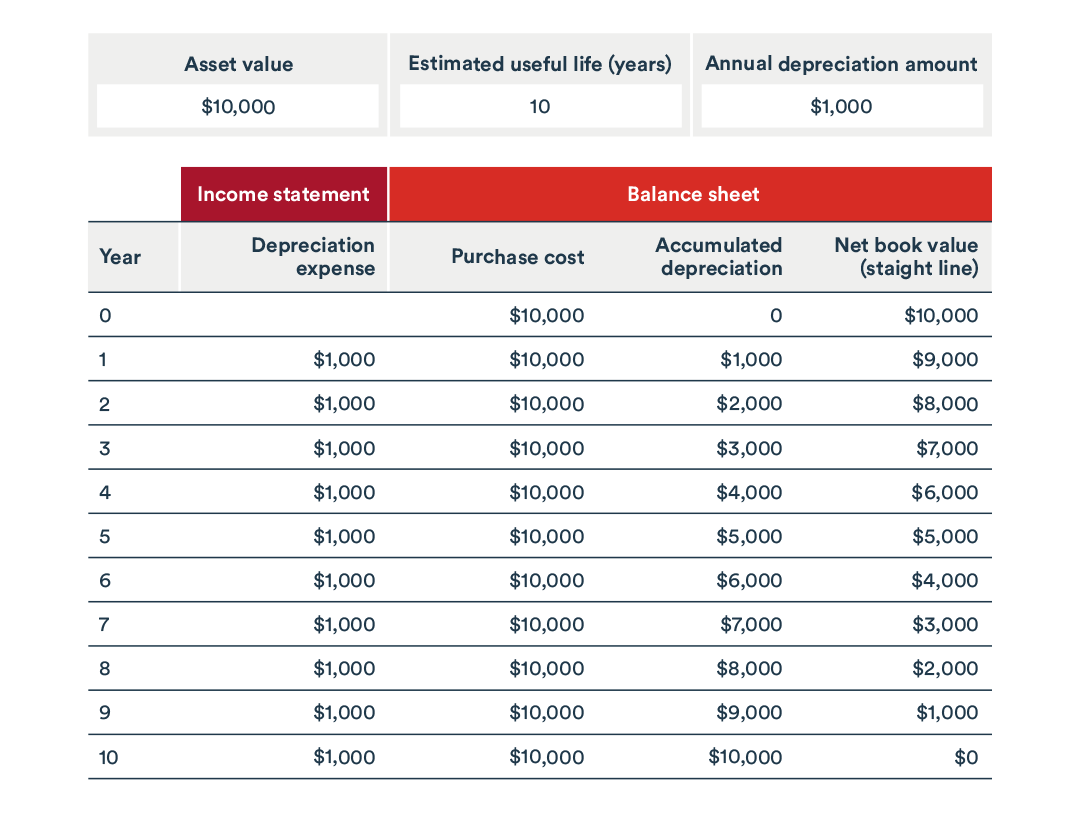

. How to Calculate Straight Line Depreciation. If you used the computer for more than 50 business use you can either. Depreciation asset cost salvage value useful life of asset.

The four most widely used depreciation formulaes are as listed below. The formula to calculate. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

The tool includes updates to reflect tax depreciation. Therefore the actual cash value Ie the value at the time of the loss of your laptop. He has a policy of charging depreciation at a rate of 15 at the reducing balance method.

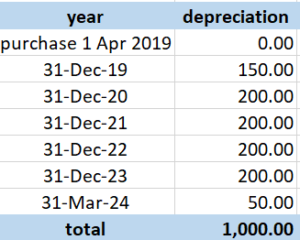

Mobileportable computers including laptop s tablets 2 years. While all the effort has been made to make this. The straight line calculation steps are.

The computer will be depreciated at 33333 per year for 3 years 1000 3 years. Find the depreciation rate for a business asset. If the computer has a residual value in 3 years of 200 then depreciation would be calculated.

To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. Base value days held see note. Determine the cost of the asset.

Straight Line Depreciation Method. Depreciation rate finder and calculator. Depreciable amount Units Produced This Year Expected Units of.

Calculating depreciation examples and tips If you would like to work out the depreciable amount you need to know the assets purchase date the assets acquisition value. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable Computers including laptops and. Divide the depreciation base by.

In the example 520 minus 65 equals 455. You can use this tool to. Calculate depreciation for a business asset using either the diminishing value.

Subtract the residual value from the cost of the asset to calculate the base for the depreciation. Subtract the estimated salvage value of the asset from. ATO Depreciation Rates 2021.

Computers and computer equipment are considered listed property. Cost Scrap Value Useful Life. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

The formula to calculate annual depreciation through straight-line method is.

How To Use R Shiny Language In Machine Learning Machine Learning Applications Machine Learning Data Science

Work Estimate Template For Excel Free Download In 2022 Estimate Template Templates Excel Templates

E Learning Marketplace Dynamic 10 Year Financial Model In 2022 Business Valuation Financial Business Plan Financial Modeling

What Is Amortization Bdc Ca

Book Value Vs Market Value Top 5 Best Comparison With Infographics Book Value Market Value Books

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Income

What Is Straight Line Depreciation Yu Online

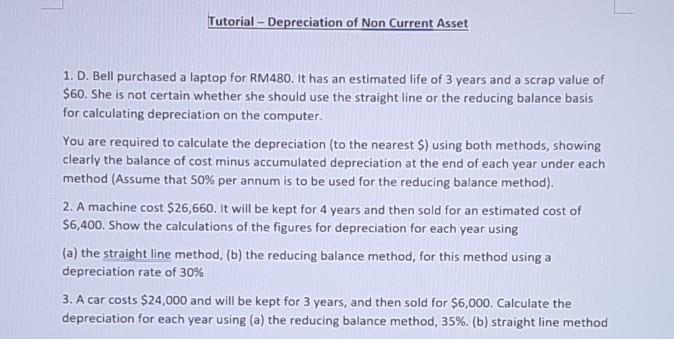

Solved Tutorial Depreciation Of Non Current Asset 1 D Chegg Com

What Are The Purpose Behind Your Business Disappointment Billing Software Accounting Software Business Problems

How To Calculate Depreciation Know Your Assets Real Value

How To Become A Confident Data Scientist R Coders For Business Science Skills Data Science Data Scientist

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop Business Card

How To Handle Tangible Fixed Assets Changing Tides

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio

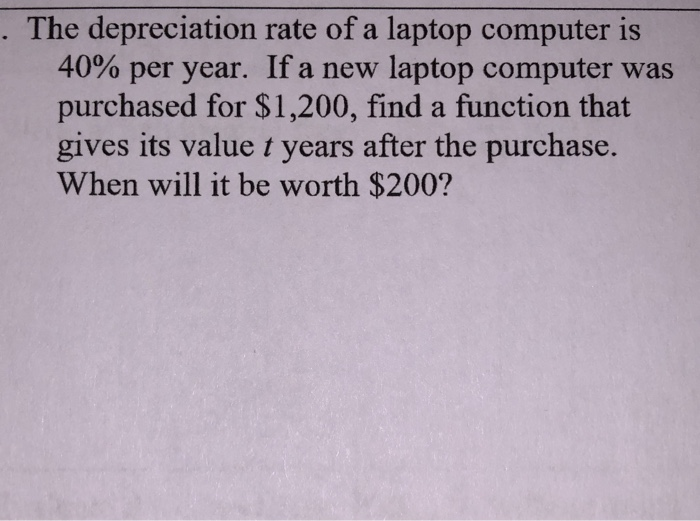

Solved The Depreciation Rate Of A Laptop Computer Is 40 Chegg Com

How To Calculate Depreciation Legalzoom

How Much Is My Laptop Worth How To Price The Old Pc